This withdrawal allows you to withdraw your Account 2 savings to finance the purchase of a residential house only. A copy of identification document for non-My Card holders 3.

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

The original copy of the Sale Purchase Agreement SPA.

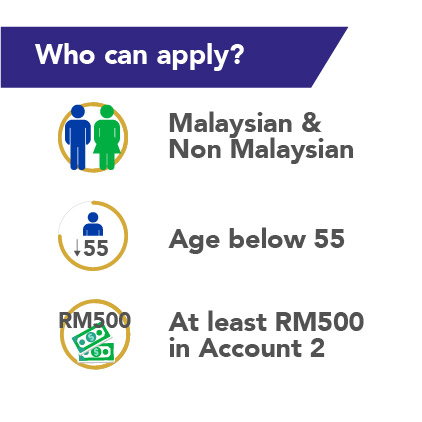

. Since PM Muhyiddin announced that citizens under 55-years-old are allowed to withdraw as much as RM500 per month from their EPF savings in Account 2 for financial aid during this precarious time many have wondered how to apply for this scheme. Members bank account information Members are encouraged to bring their bank passbook OR a copy of their bank. EPF withdrawal form Form KWSP 9C AHL.

For the first house my husband had applied to withdrew his epf. Once registered youll need to activate your account by logging in to your i-Akaun as shown below. 2 Now we would like to purchase a second house and i will be going to purchase this house under my.

Did you know you can use your EPF savings to help you in your quest to buy property or even finance the housing loan. A civil servant placed under the pension scheme. This scheme allows members to withdraw from their account II to purchase or build a house or shop house with a dwelling unit.

Withdrawal from Account 2 to build a house. Malaysians can start applying starting 1st April 2020 and lucky for you we have. TO PURCHASE OR BUILD A HOUSE UNDER THE WITHDRAWAL SCHEME.

EPF comprises of two contributions. Employees must contribute 12 of their basic pay every month towards the EPF account as per the EPF norms. ReduceRedeem Housing Loan.

Withdraw EPF for my second house Epf. WITHDRAWAL TO REDUCE OR REDEEMING HOUSING LOAN FOR SPOUSE. THE EMPLOYEES PROVIDENT FUND Locked Bag No.

1 I have a first house with my husband which is the sharing loan joint name house. EPF allows full withdrawal of Akaun 1 and Akaun 2 under certain conditions. Tax on EPF Withdrawal.

EPF Withdrawal Rules 2022. Min is 8 till 12. These 4 simple steps will help you understand how.

Withdrawal to purchase second house is allowed after the first house is sold OR disposal of ownership of property has been place. EPF has made it very convenient for home purchasers to apply for withdrawals online rather than doing it manually over the counter. When a person migrate to another country.

The full list of TCs plus the necessary supporting documents can be found at KWSPs website. Withdrawal to purchase the first house. Disposal of ownership refers to.

Residential property ROI for appreciation in line with inflation is 5 to 7 yearly rental is 3 to 5 yearly. Employees Provident Fund EPF Withdrawal To Purchase A House. EPF Withdrawal Application Form 9C AHL D5 2.

1 day ago2 Go to online service claim Form 31 19 10C. There are also different withdrawal rights according to the various EPF accounts Akaun 1 and Akaun 2. Members are required to submit the KWSP 9CAHL form to the EPF.

Photocopy of your Identification Card myKad or Passport. EPF is 6 for 2011 4. Withdrawal to Purchase a House PURPOSE This withdrawal allows you to withdraw your Account 2 savings to finance the purchase of a house.

220 Jalan Sultan 46720. When you reach a certain age the EPF allows you to withdraw partially or in full the savings in Account 2. This type of withdrawal involves you withdrawing money from your Account 2 to finance your monthly installments for your housing loan which was taken up either to buy a new house or build a new one.

I would like to get anyone advice for my condition. 4 Submit the form by clicking at submit option. Upon a person becoming disable or in the event of death.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Employee Provident Fund is a compulsory saving plus retirement scheme. Better to withdraw from EPF account 2 to housing loan as following points.

This is the most common form of EPF withdrawal. 3 Upload bank cheque leaf with your name mentioned on it. Minimum savings balance of RM500 in Account 2.

Bank account information in the form of a passbook or a bank statement. Withdrawal to purchase a second house is allowed after the first house is sold or disposal of ownership of property has taken place. Statement when making an application 4.

A copy of the letter of loan approval from your end-financier. Alternatively you can also contact the EPF Contact Management Centre at 03-8922 6000. Withdrawal to purchase a second house provided the first house is sold or disposal of the property has taken place.

LIST OF REQUIREMENT DOCUMENTS. Contributors need to go to the EPF to apply for the monthly withdrawal only once and subsequent payments would be directly credited to their. Employees Contribution and Employers Contribution.

You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time.

Kwsp Epf Partial Withdrawal Buy Home

6 Reasons For Which You Can Withdraw Money From Your Epf Account

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Epf Withdrawal For Buying House And Paying Emi New Epfo Rule

Epf Withdrawal For Flat Purchase Or Home Construction Planmoneytax

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Here S The Easy Steps To Purchase Property Using Your Epf Money

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

39 Kwsp Account 2 Withdrawal For House Renovation Pictures Kwspblogs

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

Zerin Properties Property Insights Epf Withdrawals

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Epf Withdrawal For Housing Loans Reduction To Withdraw Or Not

Kwsp Housing Loan Monthly Installment