They are explained in the table below. This includes salaried employees self-employed freelance worker and anyone who wish to better prepare for their retirement.

Epf Admin Charges Reduced From April 2017 Updated Epf Rates Simple Tax India

The Employees Provident Funds and Miscellaneous Provisions Act 1952.

. PART II THE BOARD AND THE INVESTMENT PANEL. The table below shows the changes in PPF rate of interest over the last few years. I left my job in India in 2017 and have.

Even after maturity you have the option to extend the PPF with or without contribution. Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. However in November 2017 the Bangalore bench of the Income Tax Appellate Tribunal made the interest earned on an EPF account taxable after an employee quits their job.

Employer contribution will be split as. Please refer the attached link 15th March 2017 notification. In case of non-restricted contribution PF will be on actual contribution ie 12 of 15500 1860 which is the Employee contribution.

From above example you may see a cut in your take home pay. On 17 Oct 2017 EPFO launched an online facility for its subscribers to link their 12-digit unique Aadhaar number with their Universal portable PF Account Number UAN on Oct 2017. Contribution to EPF will be 12 of Rs46000 which is Rs5520.

AC 2 AC 10 AC 21 and AC 22. It is important to know about this withdrawal process taxability premature withdrawal loan facility etc before you withdraw it. EPF contribution into an employees EPF account is made every month in equal proportion both by the employer and the employee.

The scheme is further extended to June 2020 July 2020 and August 2020. 11 is a self-assessment form employees must complete when joining an organization covered by the Employee Provident Fund EPF program under the EPF Act of 1952. Also EPF withdrawals are liable to income tax if withdrawn before five years of service.

Benefits of EPF Scheme. 050 wef 01062018 EDLIS Charges. Table D-Service Years Proportion of Wages at Exit 1.

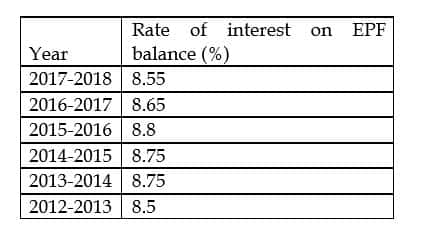

The EPF interest rate is reviewed every year by the EPFO Central Board of Trustees after consultation with the Ministry of Finance. Any extra contribution will go into EPF. The UAN is made of 12 digits allotted to all employees contributing to the EPF.

EPS contribution will be a maximum of 1250. Table below gives the rates of contribution of EPF EPS EDLI Admin charges in India. There are very strict rules and procedures regarding the withdrawal of your PPF amount.

But from now onwards it includes BasicDAAllowances. EPF withdrawals at maturity or beyond 5 years attract zero tax in case if premature withdrawal is. How to Withdraw Pension Contribution Online in EPF.

The Commission is composed of the College of Commissioners from 27 EU countries. Using new facility eKYC at EPFOs website wwwepfindiagovinEPFO members can online link their respective UAN with Aadhaar. EPF helps you achieve a better future by safeguarding your retirement savings and delivering excellent services.

Create a table of three columns and provide particular details which you need to change. Employer contribution will be split as. Particulars of reasons for withdrawal.

The Public Provident Fund. For the purposes of managing the Fund and for carrying into effect the purposes of this Act a body corporate by the name of Employees Provident Fund Board is established with perpetual succession and a common seal and which may sue and be sued in its corporate name and. The UAN is a landmark step to shift the EPF service to the online platform making it more user-friendly.

Ram Krishan got a great offer at a Public government school at a. The table must mention the incorrect entry plus the corresponding right entry. Establishment of the Board.

The review of the EPF interest rate for a financial year is set at the end of that financial year most probably in February but may go up to April or May. Check your EPF statement for EEER Contribution details. The contribution to EPF is reduced to 10 from 12 for non-government organisations.

Please bear in mind that the contribution amount should be calculated based on the contribution rate as stated in the Second Schedule of the Employment Insurance System Act 2017 instead of using the. 050 EPF Admin Charges. His employer was also making the same contribution towards the account.

Answer 1 of 4. Calculate Returns From Lumpsum Investment In 3 Steps. Together the 27 Members of the College are the Commissions political leadership during a 5-year term.

The EPFO has come up. TDS Tax Deducted at Source is applicable on pre-mature EPF Employees Provident Fund withdrawals of Rs 50000 or more with effective from June 1st 2015. EPF Online Transfer ClaimProvident Fund ac online transferEPF ac transfer via Online Transfer Claim Portal UAN Universal Account Number Member Portal.

367 Difference of ee share and Pension Contribution EPS EDLI. So if you choose to extend your PPF for another 5 years. EPF challan consists of total wages of employees and account numbers like AC 1.

More contribution of Rs1920 but less take home from now onward. EPF helps in tax saving by keeping EPF contribution tax-deductible with respect to section 80C of the Income tax act1956. Every challan consists a unique TRRN number which will help you to track the challan details.

The contribution rates stated in this table are not applicable to new employees who are 57 years old and above who have no prior contribution. You can refer to order dated 20022017 of the EPFO Online Application. PF Contribution Rate 2021 Account Wise.

So your total salary from above example will be Rs46000. EPF challan is required to make the PF contributions payments of the employee and employer. It doesnt change while changing jobs.

The EPF interest rate for FY2020-21 was 850 unchanged from FY2019-20. You are actually allowed to withdraw legally only if it has been more than two months that you are out of work. 01042017 The employer is required to pay his contribution and deduct employees contribution from wages and deposit the same with ESIC.

The UAN of the employee remains the same throughout the service life. Bifurcations of Contribution. EPF Self Contribution is an EPF scheme where registered EPF members may make additional contributions to their EPF savings with any amount and at any time.

EPF declaration form no.

Kwsp Employer Contribution Keiranjk

Epf Kwsp Dividend Rates 2019 Otosection

Confluence Mobile Support Wiki

Epf Interest Calculator Cheap Sale 51 Off Sportsregras Com

Does Interest Rate Increase Make Epf An Attractive Investment Option

Zero Epf Contribution For Above 60 Year Old Workers

Pdf The 5 Pillars Of The Social Security System For The Aged Malaysian

Epf Historical Returns Performance Mypf My

Confluence Mobile Support Wiki

Epf Contribution Schedule Third Schedule I Visit I Read I Learn

Employees Epf Contribution Reverts To 11 The Edge Markets

Deduction Of Employees Contribution To Employees Provident Fund Epf

Epf Historical Returns Performance Mypf My

Pdf Factors Influencing Confidence In The Government During Tun Dr Mahathir S Leadership Era Among Industrial Workers

Average Savings Of Epf Members At 54 Years Of Age Download Table

St Partners Plt Chartered Accountants Malaysia Epf Monthly Contribution Rate For 2021 Is Available To Download The Third Schedule Please Click At Below Link Https Www Kwsp Gov My Documents 20126 927226 Bi Jadual Ketiga 2020 Kwsp Pdf

Average Savings Of Epf Members At 54 Years Of Age Download Table